At Compass Financial Group, we believe that having a coordinated strategy to managing your wealth can provide the framework for achieving financial security. Our wealth management approach may incorporate portfolio management, retirement planning, tax strategies, and a number of other services that can provide both balance and direction for your overall objectives.

We offer a variety of services designed to help you stay on track to meet your goals. Whether you are in the accumulation stage, in retirement, or focusing your attention on leaving a legacy, we can assist you in meeting those goals.

Portfolio Management and Investment Consulting

Compass is dedicated to the total economic wealth of investors. We use a flexible, but disciplined approach using institutional quality research to work toward achieving maximum returns consistent with your tolerance for risk.

Our Investment Management Process

1. Establishing objectives

Our process begins with a thorough evaluation of your overall financial situation, your investment objectives, your tolerance and capacity for risk, and any restrictions and/or conditions that would impact the management of your investment assets.

2. Develop the Investment Strategy

Before we will begin managing investments on behalf of any client, an Investment Policy Statement is designed and agreed upon by the client to outline the parameters by which the portfolio will be managed. This Investment Policy Statement incorporates the information that we gather in our initial step.

3. Implement the Investment Strategy

Once the Investment Policy Statement is in place, we implement the allocation decisions through the purchase of various investment types, vehicles and strategies. For more on our investment philosophy, click here.

4. Monitoring and Reporting

We monitor portfolios on a regular basis and generally provide clients with quarterly consolidated reports. We meet with clients as appropriate to review investment portfolios.

Wealth Transfer & Estate Planning

A properly designed estate plan is an integral part of ensuring that your assets are protected and handled in a manner that is consistent with your desires. While most people understand that an estate plan can enable you to pass your assets to your heirs in the way you choose, there are many other reasons to address this important aspect of your financial preparation.

A well-constructed estate plan will address what happens in the event of your incapacity. It can also allow you to minimize estate taxes and probate costs. In addition, it can help to alleviate family fighting and costly court proceedings. Providing for the needs of minors and providing protection for your beneficiaries by safeguarding assets from creditors or divorced spouses are also some significant benefits to estate planning.

While our firm does not provide legal advice, we can work closely with your attorney in helping you to construct an estate plan that enables you to pass your assets to your heirs when you want and without substantial depletion from taxes and other transfer costs.

Retirement Planning

Being able to retire comfortably is one of the most common goals shared by individuals today, yet many find it difficult to assess their retirement preparedness. Increasing life expectancies coupled with rising medical costs and other future uncertainties are very real concerns that individuals and families must address.

If you have not already put into place some retirement planning strategies, the sooner you begin this process, the greater the chance you will have of meeting your retirement goals. Even if you are already in retirement, it is important to review your financial situation to help ensure that you are able to maintain a lifestyle that is consistent with the retirement assets that you have accumulated.

Our firm can evaluate your current situation and assist you in the preparation of a plan that takes into consideration your current and future retirement objectives. During this process, we analyze and recommend strategies that will allow you to improve the probabilities of meeting your retirement goals.

Tax Minimization

While we do not prepare tax returns, there are still many ways to help reduce current and future income tax liability. We can provide some of those sophisticated tax minimizing options and ideas when appropriate and can work with your accountant or other tax professionals when implementing.

Our investment process takes a tax aware approach. This approach gives first priority to the economics of any investment decision, but then supplements that decision process with a review of the tax impact. We feel that this allows us to focus first on making the best investment decision, while also being sensitive to tax implications.

Risk Management & Asset Protection

As a firm, we have a strong focus on helping our clients stay wealthy. One of the ways that we do this is by managing the risks of unexpected events. While some of our risk management techniques are implemented in our investment approach, we also want to make sure that you are sufficiently protected against risks outside of your investment portfolio. With the combined effort of our network of specialists, we can present innovative strategies to assist clients in protecting their assets from creditors and lawsuits.

We can also assist you in this area by reviewing and making recommendations regarding your existing insurance policies. This may include, but is not limited to, life, disability, umbrella liability, long term care, personal liability, home and automobile insurance.

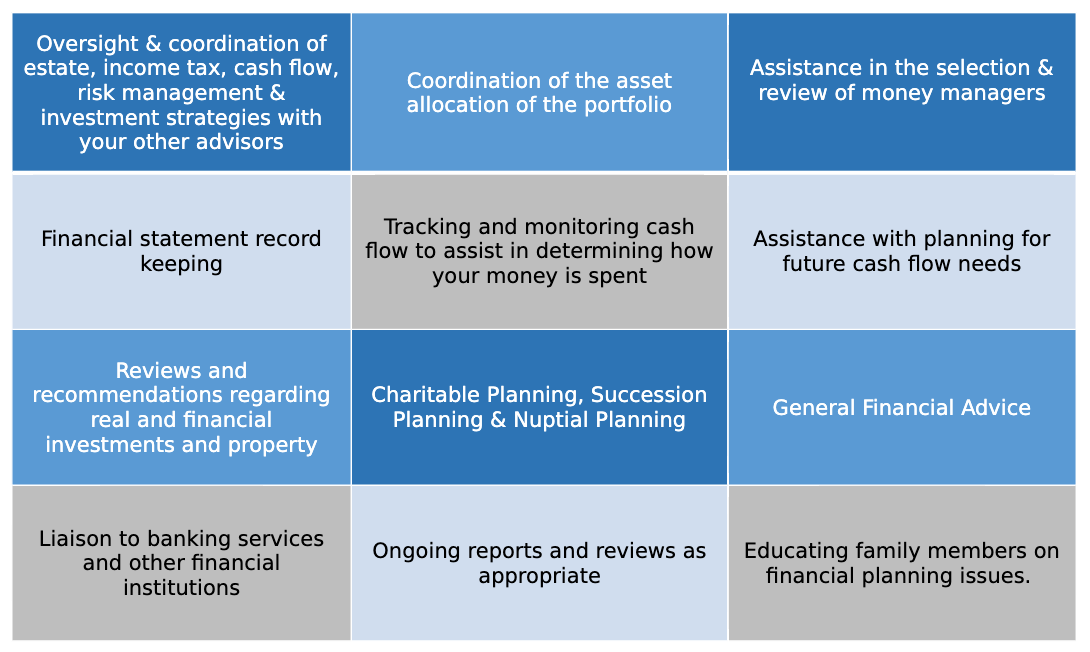

Family Office Services

We offer family office consulting services in which we can oversee various investment accounts and financial issues on behalf of the client. Our family office services also extend beyond the traditional financial services in our attempt to engage and meet the specific needs and objectives of our clients. Because each client’s needs are different, our focus may range from needs affecting young children to needs related to aging parents and the various stages between.

Depending on the needs of the client, this may include some of or all of the following services: